Chick fil a accounting test – Embark on a journey into the captivating world of Chick-fil-A’s accounting practices. This comprehensive guide will unveil the intricacies of their financial reporting, internal controls, software, and team, offering a fresh perspective on the company’s financial success.

From the fundamental accounting principles that shape Chick-fil-A’s financial statements to the robust internal control systems that ensure accuracy and reliability, this guide will delve into the depths of their accounting practices.

Chick-fil-A Accounting Practices

Chick-fil-A adheres to the Generally Accepted Accounting Principles (GAAP) and follows specific accounting methods to ensure the accuracy and reliability of its financial reporting.

Chick-fil-A uses the accrual basis of accounting, which means transactions are recorded when they occur, regardless of when cash is received or paid. This method provides a more accurate picture of the company’s financial performance than the cash basis of accounting, which only records transactions when cash is exchanged.

Specific Accounting Procedures

Chick-fil-A follows several specific accounting procedures, including:

- Depreciation of fixed assets: Chick-fil-A depreciates its fixed assets, such as buildings and equipment, over their useful lives using the straight-line method.

- Amortization of intangible assets: Chick-fil-A amortizes its intangible assets, such as trademarks and patents, over their useful lives.

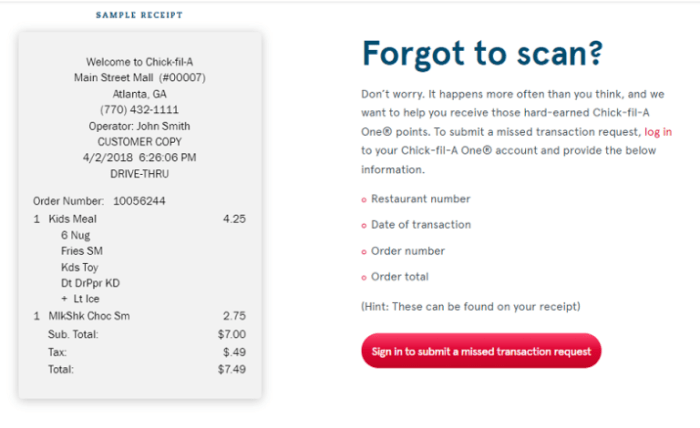

- Recognition of revenue: Chick-fil-A recognizes revenue when goods or services are delivered to customers.

- Expense recognition: Chick-fil-A recognizes expenses when they are incurred, regardless of when cash is paid.

Chick-fil-A Financial Statements

Chick-fil-A’s financial statements provide valuable insights into the company’s financial performance and health. These statements are prepared in accordance with Generally Accepted Accounting Principles (GAAP) and include:

- Balance Sheet: Summarizes the company’s assets, liabilities, and equity at a specific point in time.

- Income Statement: Shows the company’s revenues, expenses, and net income over a specific period.

- Statement of Cash Flows: Reports the company’s cash inflows and outflows from operating, investing, and financing activities.

Key Financial Ratios and Metrics

To evaluate Chick-fil-A’s financial performance, analysts and investors use key financial ratios and metrics, such as:

- Profit Margin:Net income divided by revenue, indicating the percentage of revenue that the company keeps as profit.

- Return on Equity (ROE):Net income divided by shareholders’ equity, measuring the return on investment for shareholders.

- Debt-to-Equity Ratio:Total debt divided by shareholders’ equity, indicating the company’s leverage and risk.

- Current Ratio:Current assets divided by current liabilities, assessing the company’s ability to meet short-term obligations.

Chick-fil-A Internal Controls

Chick-fil-A has implemented a comprehensive system of internal controls to ensure the accuracy and reliability of its financial reporting. These controls are designed to mitigate risks and prevent errors, fraud, and misstatements in the financial statements.

The effectiveness of Chick-fil-A’s internal controls is evident in the company’s strong financial performance and its ability to maintain a high level of customer satisfaction. The company’s internal controls have also been recognized by external auditors, who have consistently issued unqualified opinions on Chick-fil-A’s financial statements.

Control Environment

The control environment is the foundation for all other internal controls. It includes the company’s ethical values, management’s philosophy and operating style, and the assignment of authority and responsibility.

- Chick-fil-A has a strong ethical culture that emphasizes honesty, integrity, and accountability.

- Management is committed to maintaining a high level of financial reporting quality.

- Authority and responsibility are clearly defined and assigned.

Risk Assessment

Chick-fil-A conducts a comprehensive risk assessment process to identify and assess the risks that could affect the accuracy and reliability of its financial reporting.

- The company uses a variety of risk assessment techniques, including brainstorming, interviews, and data analysis.

- Risks are assessed based on their likelihood and potential impact.

- The company develops and implements control activities to mitigate identified risks.

Control Activities

Control activities are the policies and procedures that are implemented to mitigate risks. Chick-fil-A has a variety of control activities in place, including:

- Authorization and approval procedures for transactions.

- Segregation of duties.

- Physical controls over assets.

- Regular reconciliation of accounts.

- Independent verification of financial information.

Information and Communication

Chick-fil-A has a well-established system for communicating financial information to management and other stakeholders. This system includes:

- Regular financial reporting.

- Internal and external audits.

- Communication with investors and analysts.

Monitoring

Chick-fil-A monitors its internal controls on a regular basis to ensure that they are operating effectively. This monitoring includes:

- Regular reviews of control activities.

- Internal audits.

- External audits.

The effectiveness of Chick-fil-A’s internal controls is evident in the company’s strong financial performance and its ability to maintain a high level of customer satisfaction. The company’s internal controls have also been recognized by external auditors, who have consistently issued unqualified opinions on Chick-fil-A’s financial statements.

Chick-fil-A Accounting Software

Chick-fil-A utilizes a comprehensive accounting software solution to manage its financial operations. This software plays a vital role in streamlining accounting processes, ensuring accuracy, and facilitating financial reporting.

If you’re prepping for the Chick-fil-A accounting test, you might find yourself on a sort of Trojan Odyssey . Just like Odysseus, you’ll need to navigate obstacles and overcome challenges. But remember, the reward at the end is a delicious chicken sandwich and a fulfilling career in accounting.

Software Identification

The specific accounting software used by Chick-fil-A is proprietary and not publicly disclosed. However, it is likely that the company employs a robust enterprise resource planning (ERP) system that integrates various business functions, including accounting, inventory management, and customer relationship management.

Advantages

The accounting software used by Chick-fil-A offers several advantages:

- Streamlined Processes:Automates repetitive accounting tasks, such as invoice processing and financial reporting, reducing manual errors and improving efficiency.

- Centralized Data:Provides a single platform for managing all financial data, eliminating the need for multiple spreadsheets and databases, and enhancing data accuracy and consistency.

- Improved Reporting:Generates customizable financial reports and dashboards, providing real-time insights into the company’s financial performance and enabling informed decision-making.

Disadvantages

Despite its advantages, the accounting software used by Chick-fil-A may also have some disadvantages:

- Implementation Costs:Implementing and customizing ERP systems can be expensive and time-consuming, requiring significant investment in hardware, software, and training.

- Complexity:ERP systems are complex and require specialized knowledge to operate and maintain, potentially leading to challenges in user adoption and ongoing support.

- Data Security:Centralizing financial data in a single system can increase the risk of data breaches and cyberattacks, requiring robust security measures to protect sensitive information.

Recommendations, Chick fil a accounting test

To enhance the effectiveness of the accounting software used by Chick-fil-A, the following recommendations can be considered:

- Regular Updates:Regularly update the software to access the latest features, security patches, and performance improvements.

- Training and Support:Provide comprehensive training to users and ensure ongoing support to address any challenges or questions that may arise.

- Integration with Other Systems:Explore integrations with other business systems, such as point-of-sale (POS) systems and customer relationship management (CRM) software, to enhance data flow and streamline operations.

Chick-fil-A Accounting Team

The accounting team at Chick-fil-A plays a vital role in ensuring the financial health and accuracy of the company. The team is responsible for a wide range of accounting functions, including:

- Maintaining accurate financial records

- Preparing financial statements

- Complying with all applicable accounting regulations

- Providing financial analysis and support to management

The accounting team at Chick-fil-A is led by a Controller, who reports directly to the Chief Financial Officer (CFO). The Controller is responsible for the overall management of the accounting function, including the development and implementation of accounting policies and procedures.

The accounting team is divided into two main departments: the Financial Reporting department and the Management Accounting department.

Financial Reporting Department

The Financial Reporting department is responsible for preparing the company’s financial statements, which are used by investors, creditors, and other stakeholders to assess the company’s financial performance. The department also works with external auditors to ensure that the financial statements are accurate and in compliance with all applicable accounting regulations.

Management Accounting Department

The Management Accounting department is responsible for providing financial analysis and support to management. The department prepares financial reports and analyses that help management make informed decisions about the company’s operations. The department also works with other departments within the company to develop and implement financial strategies.

Qualifications and Experience

The accounting team at Chick-fil-A is highly qualified and experienced. All members of the team have a bachelor’s degree in accounting, and many have also earned a master’s degree in accounting or a related field. The team also has a wide range of experience in the accounting field, including experience in public accounting, corporate accounting, and government accounting.

Suggestions for Enhancing Skills and Knowledge

The accounting team at Chick-fil-A is committed to continuous learning and development. The team regularly attends training programs and workshops to stay up-to-date on the latest accounting trends and developments. The team also participates in professional development activities, such as serving on committees and volunteering for community organizations.In

addition to formal training and development programs, the accounting team at Chick-fil-A also benefits from a strong mentoring program. Senior members of the team are paired with newer members to provide guidance and support. The mentoring program helps newer members of the team to develop their skills and knowledge and to become more effective in their roles.

FAQ Overview: Chick Fil A Accounting Test

What are the key accounting principles used by Chick-fil-A?

Chick-fil-A adheres to the Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS).

How does Chick-fil-A ensure the accuracy and reliability of its financial reporting?

Chick-fil-A has implemented a comprehensive system of internal controls, including segregation of duties, regular audits, and strict adherence to accounting standards.

What accounting software does Chick-fil-A use?

Chick-fil-A utilizes a proprietary accounting software system tailored to meet the specific needs of their business.

What are the qualifications and experience of the Chick-fil-A accounting team?

The Chick-fil-A accounting team consists of highly qualified and experienced professionals with backgrounds in accounting, finance, and auditing.